Content

This is especially attractive to those who have always wanted to join the decentralized ecosystem but never had the means to do so. Now that you know what liquidity mining is, the next step is to consider whether it is a good investment approach. Liquidity mining can be a good idea, especially since it’s extremely popular among investors as it generates passive revenue. This means that you can profit from liquidity mining without having to make active investment decisions.

When not charting, tweeting on CT, or researching Solana NFTs, he likes to read about psychology, InfoSec, and geopolitics.

As a result, finding enough users willing to trade regularly was challenging. Impermanent loss is something that keeps most people out of liquidity mining simply from the fear that they will lose a portion of their gains. Binance has a really good explanation of impermanent loss that can be found here. I highly recommend watching their 3 minute video to gain an understanding of what impermanent loss is. For the next example, let’s pretend there’s a project called YYY that is offering YYY tokens through liquidity mining. Traders that swap DAI for ETH pay a small trading fee which is paid to ETH-DAI LPs.

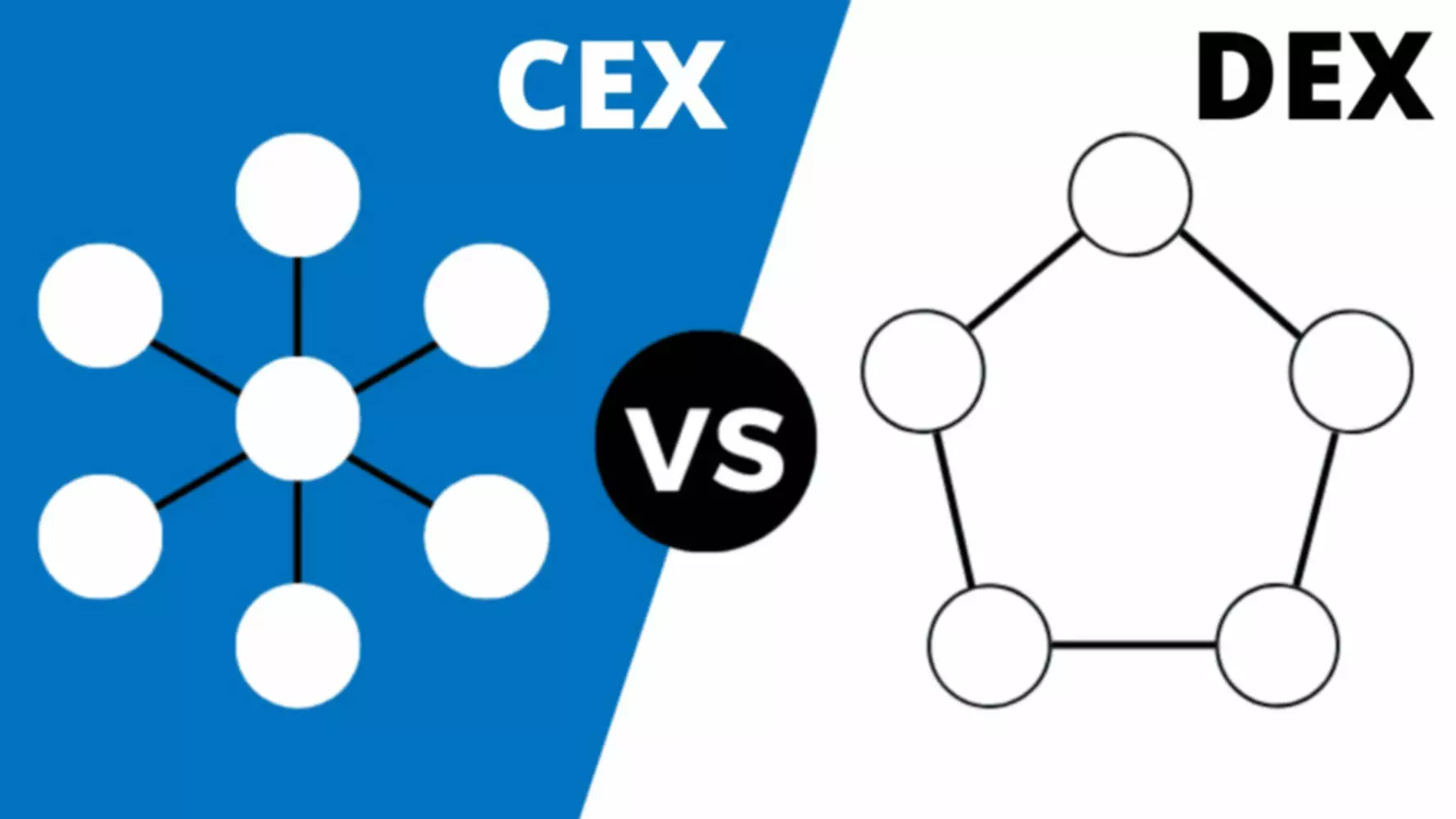

What Types Of Dex Are Out There?

A liquidity poolis a collection of coins or tokens which are locked securely in a smart contract. Automated market makers,yield farming, borrow-lend protocols, and even blockchain games all rely onliquidity poolsas an essential component of the decentralized environment. One of DeFi’s primary features, theliquidity pool, was developed in response to the growing dominance of centralized exchanges.

They can also use their gains to buy more interest in the liquidity pools. In crypto liquidity mining, you earn rewards by letting a decentralized trading service work with some of your cryptocurrency tokens. These tokens will facilitate low-friction trades between anonymous crypto holders. Of the several liquidity mining risks in this guide, the one to focus on is the potential risk to the protocol and the project. Even though all projects can be exploited, it’s still highly recommended that you perform extensive research on a project and its platform before you decide to place your assets into its liquidity pool. The individuals who provide liquidity also tend to use the protocol and hold tokens well after they’ve invested their cryptocurrency assets.

How Does Liquidity Mining Work?

According to DeFipulse, there are already 120 DeFi platforms with more than $80 billion in TVL, demonstrating the growth of liquidity mining since its beginnings. In light of this, the many sorts of protocols would be brought up as another crucial point in any discussion on liquidity mining. Now that we are familiar with the fundamentals of decentralized finance.

- Volatility profiles based on trailing-three-year calculations of the standard deviation of service investment returns.

- Liquidity mining has the advantage of establishing a loyal and trustworthy community.

- Simply put, yield farming is depositing your coins to earn interest on them.

- When an item can be sold fast without the price falling much below the targeted price, it is termed highly liquid.

- Liquidity mining is an excellent means to earning passive income for crypto assets that could have otherwise been hodled without the extra benefits.

By participating as a liquidity provider, a crypto investor helps in the growth of the nascent Decentralized Finance marketplace while also earning some returns. Liquidity mining is one of the more common ways of yield farming where investors can earn a steady stream of passive income. In this guide, we will discuss what it is, including the risks and benefits to investors engaging in the practice.

Using this investment strategy, users can then provide liquidity to facilitate these transactions. This also means that the vast majority of liquidity pools are between trading pairs, with users depositing one of two cryptocurrencies depending on What Is Liquidity Mining the pool. Liquidity Miningis the process of supplying liquidity to a decentralized exchange and receiving native platform tokens or transaction fees as compensation. Both the crypto exchange and token issuer reward the community for liquidity.

A stock’s liquidity generally refers to how rapidly shares of a stock can be bought or sold without substantially impacting the stock price. Stocks with low liquidity may be difficult to sell and may cause you to take a bigger loss if you cannot sell the shares when you want to. A cryptocurrency is a digital asset that may be used as a medium of exchange.

DeversiFi has some impressive features, like support for pooled liquidity pooling and almost no exchange fees because of how quickly transactions are processed. Traders can use the DeversiFi STARKEX smart contract to enable off-chain transactions while maintaining the balance on the on-chain, as it enables both public and private cryptocurrency wallets. With each new development, conventional ideas about technology and money are challenged on an everyday basis. Recent years have seen a huge increase in the usage of blockchain technology and cryptocurrencies, which has had a profound impact on a variety of industries. At the same time, the most popular strategy for investing in cryptocurrencies is to acquire and hold them until their value increases.

If a crypto project faces any flaws, participants can lose money to hackers or inefficient software. Project founders with bad intentions can shut down a project and vanish with the funds. It’s always important to carry out due diligence before investing in a project. Lending & Single-Asset Vault Provide Single-Asset liquidity to earn income.

Liquidity Mining Vs Yield Farming

The same is true if you want to dip your toes in before fully committing to the liquidity mining strategy. WhenDeFiliquidity mining was first introduced by IDEX, it existed in the form of a reward program which provided certain benefits to participants on the exchange. Instead of locking capital in a separate pool, participants were given IDEX tokens once they made the decision to provide liquidity.

Since your investment is essentially used to facilitate decentralized transactions, your rewards usually come in the form of trading fees that accrue whenever trades occur on the exchange in question. Since your share of the liquidity pool dictates what your yields are, you can essentially estimate what your rewards will be before you’ve even invested. There are several decentralized exchanges that incentivize liquidity providers to participate within their platforms. The most popular are UniSwap and Balancer, which support Ethereum and Ether-related tokens on the ERC-20 standard. PancakeSwap is another popular DEX where you can liquidity mine with support for Binance Smart Chain-based assets. Liquidity mining is an investment strategy in which participants within a DeFi protocol contribute their crypto assets to make it easy for others to trade within a platform.

In exchange for their contributions, the participants are rewarded with a share of the platform’s fees or newly issued tokens. The revenue of the Liquidity pool is from the transaction fee when end-users make transactions, such as borrowing, lending, and exchanging coins. This new form of mining rewards profits for investors who already provide liquidity into their protocol. These two strategies are simply ways to put your idle crypto assets to work.

It was introduced by IDEX back in 2017, fine-tuned by Synthetix and decentralized oracle provider Chainlink in 2019, and started being used at full throttle after Compound and Uniswap popularized it in June 2020. As of today, it’s been adopted by several protocols and is considered to be a smart and efficient way of distributing tokens. The majority of these protocols are decentralized and allow almost anyone to become part of the liquidity mining process. Unlike the other two protocols, the third kind of liquidity mining employs a method to reward community members who spread the project’s word. To get governance tokens, interested parties must advertise the DeFi platform or protocol.

One of the main risks for liquidity miners is when the tokens you contributed to a liquidity pool can become worth less than you did when you first deposited them. The profits from the LP rewards may occasionally be able to offset this unrealized loss, but cryptocurrency assets are extremely volatile and have dramatic price swings. Yield – this is the reward offered to liquidity providers in the form of trading fees or LP tokens. In other DeFi platforms, yield is the interest rate accrued to participants for providing liquidity or holding stakes in these projects. You can still make profits by simply trading DeFi assets and rebalancing portfolios that hold the governance tokens of your dearest lending or DEX protocols.

What Is Liquidity Mining? A Beginners Guide

The majority of banking, lending, and trading activities are controlled by centralized systems that are run by regulating organizations. To obtain everything from home loans and vehicle loans one must interact with a variety of financial intermediaries. DeFi opposes this centralized financial system by making peer-to-peer trades more accessible to the general public and disempowering intermediaries and gatekeepers. After exploring liquidity mining and yield farming you will have the chance to explore impermanent loss in more detail in a separate lesson.

Decentralized exchangesare cryptocurrency exchanges that allow for peer-to-peer transactions, which means that an intermediary such as a bank is unnecessary. This type of exchange is fully autonomous, and is managed by algorithms as well as smart contracts. UniSwap is arguably the largest decentralized crypto exchange with a current trading volume of more than $800 Billion. The platform supports Ethereum and ERC-20 tokens (only Ethereum-hosted assets). Passive income – liquidity mining is an excellent means of earning passive income for the LPs, similar to how passive stakeholders within staking networks.

Impermanent Loss

Staking refers to locking up your crypto for a defined or undefined period to get rewards . Staking is more straightforward and more accessible to novice traders and crypto enthusiasts. The third issue with liquidity mining is the possibility of rug pulls, one among many crypto scams. DeFi rug pulls can always happen easily, and this usually affects newly launched tokens. A creator of a liquidity pool might shut it down at any time and walk away with the assets that you’ve invested.

Get access to US stocks and commodities through newly launched DeFiChain dStock Tokens – Captain Altcoin

Get access to US stocks and commodities through newly launched DeFiChain dStock Tokens.

Posted: Mon, 10 Oct 2022 19:35:17 GMT [source]

Staking is concerned with providing security to a blockchain network, whereas liquidity mining is concerned with providing liquidity to the DeFi protocol. The liquidity mining protocol gives users a Liquidity Provider Token in exchange for the trading pair. Liquidity mining, as we’ve seen, involves providing liquidity in exchange for “mining” rewards.

Top Liquidity Mining Pools

Liquidity essentially refers to a fund’s liquidity, which is defined as the ability to buy and sell assets without causing any sharp changes in the asset’s market price. This is a key element in the functioning of either a new coin or a crypto exchange and is dependent on some parameters, including transaction speed, spread, transaction depth, and usability. Impermanent loss means that the value of a user’s crypto assets within a pool could decline with time.

Though liquidity farming or mining offers numerous opportunities for DEXs and DeFi to thrive, it also has significant drawbacks. Liquidity mining may or may not turn out to be a profitable long-term cryptocurrency investment strategy depending on how quickly the blockchain industry expands, and the results are still awaited. Here are a few of the noteworthy entries from the best crypto liquidity pools for 2022, along with a summary of their salient features.

Not only that, but we also highlight some of the best liquidity mining platforms for anyone looking to make use of their packed crypto. Impermanent loss is another thing to be concerned about when it comes to liquidity mining. However, https://xcritical.com/ the fluctuation of token prices is always possible, even a given. A typical scenario might involve a case whereby you still get the same amount of assets in which you invested, but those assets now have a much lower value.

A Beginners Guide To Decentralized Finance Defi

It provides investors with an option on what to do with their reserve coins. Liquidity mining is becoming increasingly popular amongst crypto investors for a good reason. Vote on crucial changes to the protocols, such as fee share ratio and user experience, among others. Governance tokens are cryptocurrencies that represent voting power on a DeFi protocol.