Contents

Moreover, this broker offers deep leverage options and the ability to use some useful third-party trading applications. Our experts find AxiTrader a reliable broker since it’s regulated by good regulations from top-tier FCA and ASIC. AxiTrader provides a range of trading platforms, and various funding methods, with average spreads and excellent customer support. We noticed that Axi has low forex fees, and deposits and withdrawals are free of charge. I like the trading experience at Axi as the Pro account offers raw spreads from 0.0 pips for a commission of $7.00 per round lot. I also appreciate the swap rates, which accurately reflect the global interest rate environment, free of excessive broker mark-ups, as evident at many brokers.

In comparison with other brokers on the same level, like Pepperstone and IC Markets, you can see the fee differences. Pepperstone charges $14.9, $11.9, $3.7 and $12.5 respectively for the same pairs. IC Markets charges $15.8, $10.6, $4.8 and $12.1 respectively. There is no official mention of any AxiTrader deposit bonus or promotion of that kind. If you find anyone offering a bonus in the name of AxiTrader, you would be wise to ignore it.

This trading terminal is highly praised by traders and brokers alike due to its ease of use and great functionality. The MT4 offers top-notch charting and flexible customization options. It is especially popular for its automated trading bots, a.k.a. Expert Advisors. Spreads and commissions vary depending on what kinds of trading accounts you are holding. The minimum spreads in the Standard account start from 0.4 pips, and 0 pips in the Pro account, with a commission of $7 per lot.

Is AxiTrader Safe or Scam?

One account, which is called the MT4 Standard account has spreads starting from 1 pip, while the second one, called MT4 Pro account has no spread at all, but is based on commissions. Considering that 1 pip is the industry standard for most Forex brokers it’s easy to say that AxiTrader passes this round as well. But should that 1 pip be applied to major currency pairs like EUR/USD then it would be considered as a disadvantage.

Besides competitive trading costs, Axi offers traders the third-party trading analysis platform PsyQuation. It can help traders improve their performance, which I find an excellent tool. Axi also uses the PsyQuation score for its AxiSelect program, which funds talented traders with capital, a rare and unique feature. Overall, we found the main Axi offering that adheres to accessing the online trading world with ease for fresh graduates, as well as sophisticated enough solutions for experienced ones. A truly comprehensive range of tools, at AxiTrader’s mainstay MetaTrader 4 brings a very competitive technical solution to trade through market-making execution.

It has all the great features that make it easy for any trader to take advantage of the provisions offered by the Pro Account. That is why AxiTrader is so dedicated to building trust and ensuring proper regulation. There is no minimum deposit at Axi, resulting in applicable requirements based on payment processors. Axi offers some of the best swap rates industry-wide, something I urge traders to consider who keep positions open overnight, as it makes a notable difference. Axi does charge an inactivity fee, which adds to the excellent cost structure. All Axi subsidiaries offer negative balance protection and segregate client deposits from corporate funds.

Axi review summary

Personally, I’m very satisfied with AxiTrader and plan on growing my real trading account with them over the years to come. I have worked for brokers, I have worked with brokers, I have liked some, I have hated others, but never has any broker satisfied all my quality criteria. And that’s not all – it also adds news feeds, helps you analyse your trades, and more. Plus, you can even un-dock the feature and place it anywhere on your desktop. Not available anywhere else, MT4 NexGen is an invention of AxiTrader that will forever change your trading experience.

As we’ve mentioned multiple times in other reviews, the FSA license is no better than no license at all. However, once we found out that the brokerage was owned by a credible corporation from Australia, all of our concerns were gone completely. It is also impossible to get an AXITrader bonus, as the company does not entertain any promotions. The company had offered bonuses in the past but has faced several criticisms on their terms and conditions.

The best part about any broker is what they can offer you, which is unique. AxiTrader may not have the best platform provisions, but they have unique features that make them a good choice to trade with. AxiTrader excels in this field as they provide you with a host of tools that you can use to make the most out of the MT4 platform. Here are some of the features included in the MT4 platform that you can use to make your trades better. MT4 is only a great software when it has access to all the great plugins, extensions, and other third-party tools that open up a new world of possibilities for traders.

Who is the CEO of AXI?

Rajesh Yohannan is the current CEO of Axi. He previously worked at OANDA as a Managing Director and CEO.

The AXITrader is regulated by ASIC and the FCA since its main seat is in Australia and the branch office in the UK. This is good news for all AXITrader investors since both regulators are known as responsible institutions which genuinely try to keep the financial market safe and fraudsters away. The most surprising info about this broker is that it accepts US clients since European brokers never do. This is mostly because the trading laws are different and what is legal in Europe, isn’t in the USA.

Trading Conditions

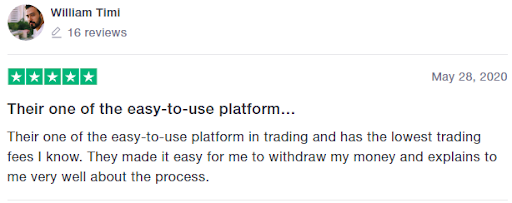

You can access 140+ currency pairs for forex markets, a $0 minimum deposit, and fast execution with award-winning customer support all from one location through MT4. As a broker who works internationally, the AXITrader opted for the standardized MT 4 platform which is preferred by Australian as well as UK clients. The simple trading software is well equipped for beginner and professional needs. Yet again, the broker offers no re-quotes to the delight of many traders. Since mobile trading became inseparable from the Forex industry because the majority of traders want to have both options, tot rade from home and on the go.

How long does axi withdrawal take?

Withdraw your funds

All requests will be processed within 1-2 business days upon receipt.

You should note that those are recommendations, in case you would like to use PsyQuation. A VPS hosting service uses a virtual private server that mimics a dedicated server’s behavior and the environment in a shared environment. Using the VPS, brokers can provide clients with direct ISP connection to physical hardware. Relatively new traders in the market will find this tool very useful. Autochartist is used to identify chart patterns by tracking indicators like Fibonacci retracements. The tool monitors the markets 24 hours a day and tells you when a trade opportunity shows up.

Regulation and Security

AxiTrader is a STP broker which provides 2 types of account, Standard account and PRO account. Hi Ricardo, please note that the difference in the amount is due to bank fees which Axi does not have control over. Kindly note that we did send the funds to your bank last October 26th based on your bank instructions. When we recall the funds we do not have particular time to received the funds as this depends from your bank or the intermediate bank. In the table below, you can compare the features of Axitrader , AxiCorp side by side to determine the best fit for your needs. To determine the safety of our top brokers, our experts will consider many factors.

Axi is recognized by many investors for its product market coverage and the tools offered to assist clients with the implementation of their trading strategies. Moreover, the broker doesn’t distract the customer with lots of account types and unnecessary frills. Axitrader offers the industry-recognized MT4 trading platform, followed by a WebTrader.

The use of these applications is suitable for specific circumstances, which is why AxiTrader clients must determine their use for their needs.

- To get a clear look that contains everything that you need to know, we have to look at the details of how much you would have to pay if you were trading.

- Outsourced training is further complemented by in-house educational content, which contains high-quality articles.

- I’m here reading your post to enter the contest to win $3000 USD in trading money.

- AxiTrader Leverage as a regulated broker in various jurisdictions complies to provide different trading conditions according to regulatory obligations set.

Tradeview supports bank wire transfers, credit cards, Skrill, Neteller, STICPAY, Fasapay, and many other deposit and withdrawal methods. Online trading involves significant risk, and you may lose all of your invested capital. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

BrokerChooser is free to use for everyone, but earns a commission from some of its partners with no additional cost to you . We tested it and collected the options and costs in How to withdraw money on Axi. Our ultimate guide to the Axi minimum deposit is updated regularly. Axi is regulated by a number of top-tier financial authorities. It is a well-established brand but it is not listed on any exchange and it doesn’t hold a banking license.

To compare transaction costs across different brokers, our experts analyze the transaction-specific fees and non-trading fees . All spreads https://broker-review.org/ with Tradeview are a floating type and scaled with the asset class. For example, the EUR/USD spread is floating around 0.3 pips.

Tight spreads and fast execution come as standard on all accounts. The AxiTrader’s clients as well enjoying direct access to various liquidity providers from over 14 world’s largest banks. There is likely to be a high risk of losing money when trading with the AxiCorp Financial Services Pty LTD because the license stands suspended. Till the time it gets reinstated, traders may find the trading platform a bit dicey.